Markets seem to be moving a bit faster than anticipated in our models laid out in the 2024 outlook special report. With both highs and potential lows coming in earlier than expected it begs the question, where to next? Penning Capital Managements CIO, Timothy Hellberg is here to share his thoughts in this edition of The Penalyst.

ADAPTATION & DIVERSIFICATION

Adaptation and diversification. Those are the two key values of PCMs investment & risk strategies. The predictive model for 2024 of Bitcoins price that we paved out earlier this year, seems to play on the correct levels, although moving at a faster pace than expected.

The January high came in earlier than expected, much due to more aggressive front running of the long-awaited ETF approvals from the SEC in the US, and one has to wonder if the rather violent selloff that followed was strengthened by the anticlimactic news as the SEC Twitter accounts where hacked. Buy the rumor, sell the fact has never been a more viable way forward.

What followed was a good couple of weeks with most of our proprietary predictive systems showing most, if not all, readings in the red. There was simply no reason to go long. Yet…

At PCM we reminded ourselves of our two core values for the investment & risk work and took a slower approach to the market, waiting for a clearer direction.

BULL OR BEAR?

So where do we go from here you might ask yourself? Well, as markets are moving faster than our model for 2024, it is still a bit early to determine if the whole model just needs to be shifted to the left, and speed up, or if we are just in for a couple more fluctuations than expected.

What we can say, is that BTC put in what seems to be a short to mid-term low around 38.550 which for now invalidates any short bias on our side. Mainly of this in combination with several of our models turning green on the same timeframes, the most likely way right now seems higher.

The chart tells us the 43-44k area shows the immediate signs of resistance, although in the bigger picture, this is pretty weak, as it is a purely technical level for now.

In the early days, I just studied and traded the principles of Elliot Wave, a predictive way of looking at the market in terms of waves up and down, based on fractals with the idea of identifying investor behavior and capital flows.

Looking at BTC from an Elliot Wave perspective would suggest we are now ending wave 4, with wave 5 aiming for the 52.700 level.

I personally think that is a bit aggressive, but from a technical point of view (and the below-described fundamentals) I would say the 50k level for the end of Q1 is a very viable target. This would further be in line with shifting the 2024 model to the left, speeding it up.

Is this written in stone? No, of course not. But as investors and traders, we need biases and broader projections to work out of.

SUPER BOWL, GOOGLE ADS

Earlier in the month I outlined a scenario in a post on LinkedIn, where I highlighted the 9th of February as a date of interest to start looking for long exposure again, IF this bottom cemented itself, as it’s done now. The reason for that specific date is that there is a lot of rumors in the market that several of the large ETF issuers have bought extensive marketing packages for the Super Bowl final, which would mark the first real milestone of Bitcoin ETFs being marketed to the general public.

Further supporting this thesis, is the fact that as news over the weekend hit the wires of Google having approved advertising of crypto ETFs, the price of BTC popped +2.3% over the next few hours.

MINERS PROVIDING THE SUPPLY

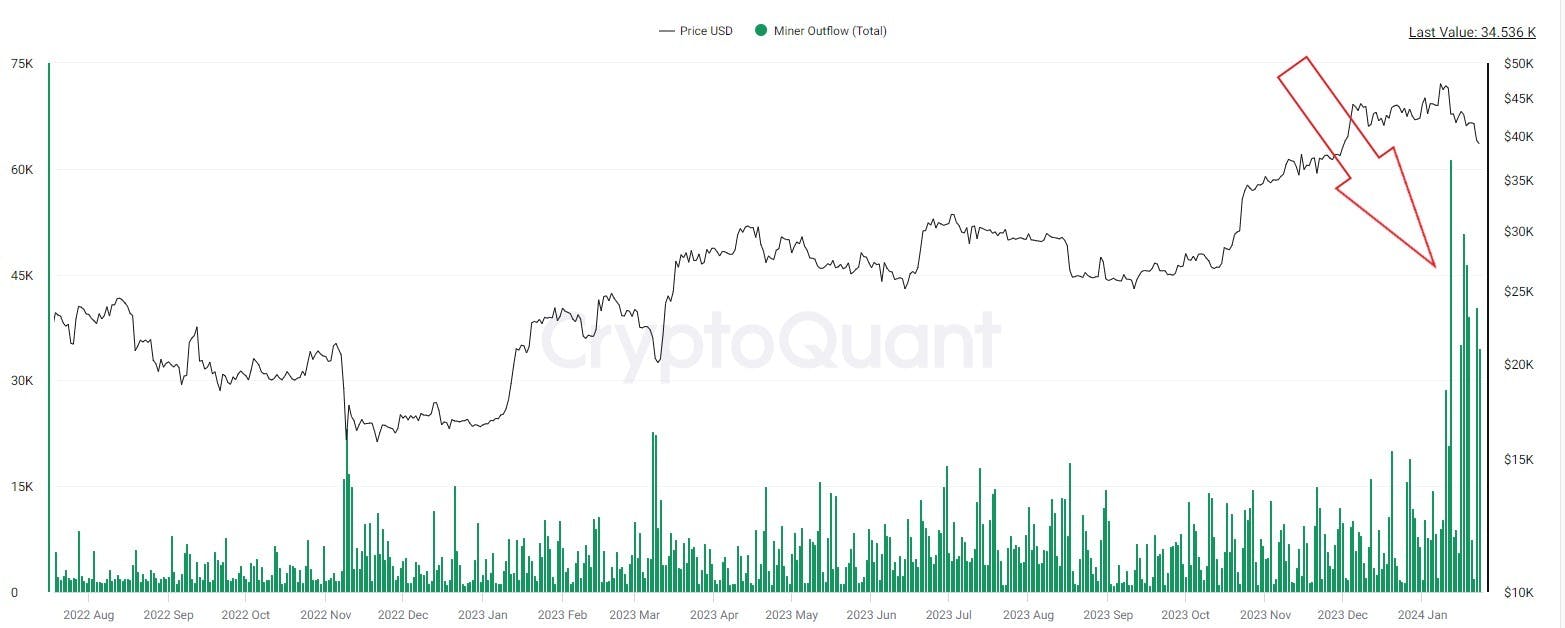

A question that the markets wanted answers into the launch of the Bitcoin ETFs, was how these new, large-scale institutions were going to source the supply for their rather large orders. And we got a rather surprising answer to that question.

We typically see miners stockpile BTC into halving events as the one coming up in April, but just the other week we saw the biggest miner outflows since 2021.

I believe the large institutions decided to source some supply from ”the source”, willing to offer miners a premium for ”selling early”, as the institutions don’t mind holding for a long time, and the miners most likely got a deal that made sense economically.

ON-CHAIN ACTIVITY

And so to wrap this up, we are seeing the Grayscale outflows significantly slowing down, which was an absolute necessity for the price of BTC to stop its decline.

Furthermore, Tether minting has resumed, indicating that fiat is moving into digital assets again, with 1 billion USDT minted at Tether Treasury on Monday the 29th in the form of an authorized but not issued transaction. This means this account will be used as inventory over the upcoming period suggesting there is an upcoming, large-scale need of moving fiat into the system.

CONCLUSION

If you made it all the way here, I’m sure you now understand the technical levels outlined in the beginning of the report make a lot of sense, and are backed by some real solid macro developments.

At PCM, we are watching the 43k level as the area of interest to start building into longs with the 50k area as a target into the end of Q1.

Let’s see what the future holds in store.

- Timothy Hellberg

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group, it's subsidiary Penning Capital Management A/S, and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.