Risk ON, the USD gets no love and BTC has a clear base to trade off with some slight moves indicating an upside. Correlations are back for now, at least in markets, but the macro environment is still received oddly by the market showing elevated levels of FUD.

Something that I often hear in trading circles is statements like “don’t focus on too many markets, it will only confuse you.” And to some extent, I guess it’s true if you are a novice trader just starting out.

However, something that I’ve almost always seen as the big turning point when coaching other trades is when they start understanding the Intermarket correlations. If you only look at BTC and try to understand why BTC moves as it does, it will never make as much sense as if you understand why and what the US dollar is doing, the NASDAQ, and as such the general risk sentiment of the market.

As this is the first post of The Penalyst, I will just take a quick passage to explain some language I use and why. I don’t do predictions and don’t want to do so either. Sometimes I will talk about projections for certain assets, but these are based on whatever data and bias I hold for the moment and can change on a dime if the data changes. As such, they shouldn’t be mistaken for predictions.

And that brings us to next term you will hear me use a lot. Bias. This refers to my “preferred viewpoint” with the current data at hand. Depending on a certain dataset and/or fundamental factors I will hold a more or less strong bias for an asset, meaning that I think the odds are slightly tilted in favor of such development.

So with that said, into the charts we dive.

Bitcoin (BTCUSD)

Jerome Powell decided to change his narrative last week. The language he used in his speech indicated that the FED is seeing some signs of strain on the economy from the recent interest rate hiking cycle. The market was not late to jump on it. Risk assets rallied and although no parabolic moves happened in BTC, this outlook likely cemented the current base of which BTC tries to stage a prolonged bounce out of further.

Looking from a market cycle, December tends to be good for risk assets, and with the fallout from FTX still spreading, it is noteworthy that BTC has yet to set a lower low.

As such, my current bias remains to the upside, although technically speaking we have a long way to go before we overtake the 200-day moving average throwing this pair well into bullish territory.

As such, strength is viewed as temporary for now, and a larger catalyst will be needed to push BTC higher or below its current base. There is still A LOT of cash sitting on the sidelines.

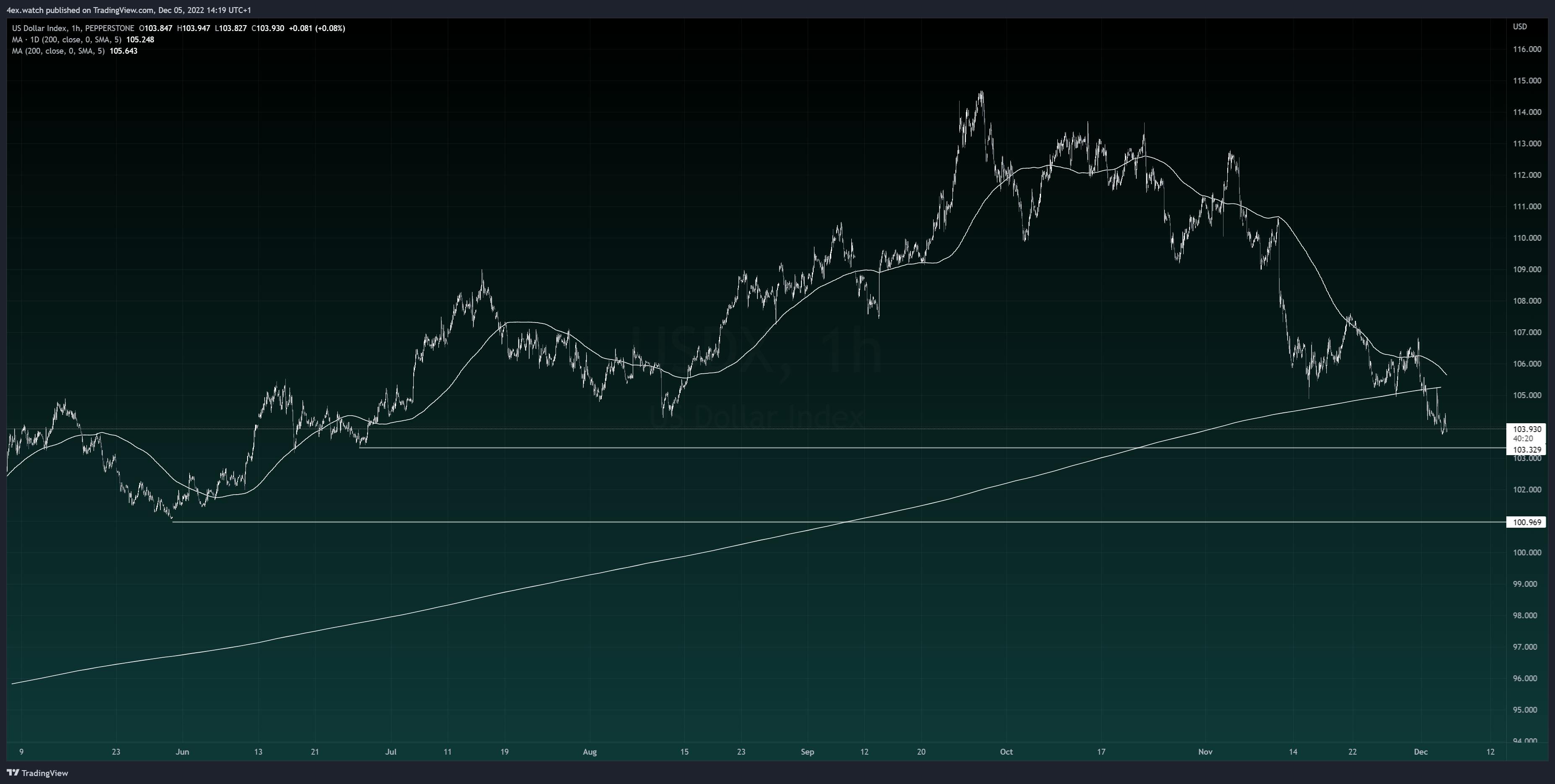

US Dollar Index

The USD falls right in line with recent market developments. Risk ON and the USD gets hammered as the world's reserve currency gets exchanged into risk assets.

Unlike BTC, the USD has made some significant developments taking out the 200-day moving average, whilst providing some very straightforward price action, not being able to make higher highs, and capitulating in a true textbook way from both a technical and a fundamental view.

Further weakness would be my bias, with some weaker support coming up around the 103 level, and in extension, the 100 level is the one to look at.

A weaker dollar would to some extent mean a stronger BTC, but I doubt we see any truly meaningful developments in either before year-end. As a matter of fact, expect year-end flows from hedge funds and other institutions to create some unpredictable price action, although I would expect this to be somewhat RISK ON supportive as long as Powell’s rhetoric doesn’t change hawkish again and/or a string of economical data changes the outlook. A lot of funds are underwater for the year, as such any chance to better these numbers for the yearly ROI will be taken. A Christmas rally in risk assets would provide just such an opportunity.

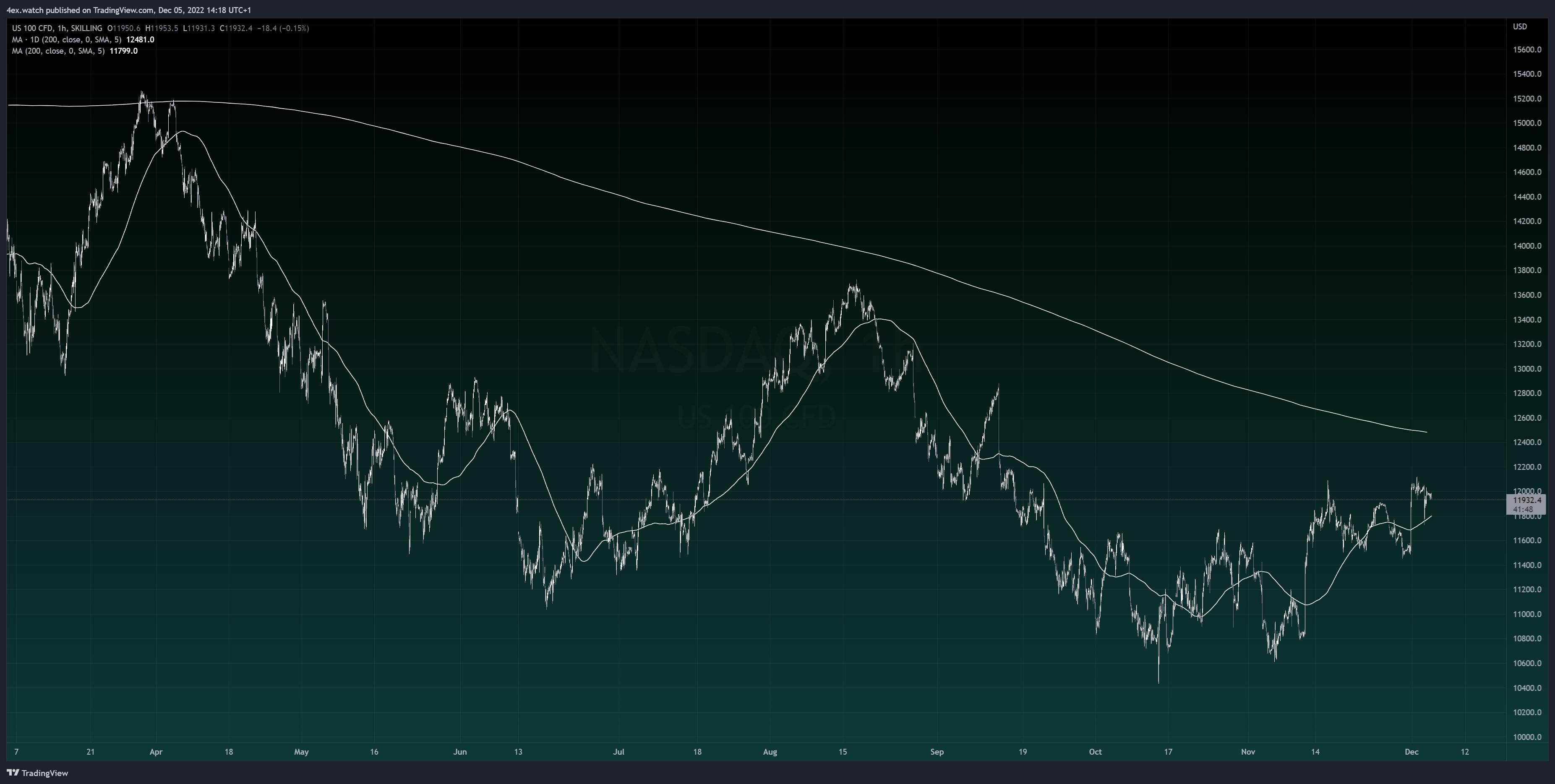

Nasdaq100

For quite some time, the Nasdaq and the price of BTC moved in tandem, and I used to call BTC “the leveraged tech trade”, meaning with its close correlation in price action to the Nasdaq but with greater volatility it was more or less the same trade with more or less leverage inside the asset.

That correlation has gradually faded with each rate hike, and no longer is worthwhile looking at.

However, the Nasdaq remains on my watchlist as a good risk indicator.

Tying into the already mentioned risk sentiment of being RISK ON, the Nasdaq decided to rally on Powell's rhetoric too, however, this was slightly offset by Friday's US jobs report that showed a stronger number than expected, to which the market in a backwards way decided to selloff on and react as RISK OFF. How odd the times are when a strong labor market is viewed as something negative. But, in current markets, good numbers indicate further rate hikes to stifle inflation. And higher rates are not something the market wants right now.

Technically speaking, there is still some more room to the upside, as we have taken over the 200-hour moving average. However, it will be how the Nasdaq handles the 200-day moving average that truly matters, as this has been well respected before.

So to conclude, all points towards a Christmas rally. But if this actually turns into really rests on a very weak case of inflation keeping calm and the FED not even hinting at a hawkish stance again. Any such indications and the careful confidence the market is currently showing will evaporate faster than one can say “FTX Risk Management”.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.