US inflation takes a hit, the FED and the ECB are ready to send the world economy into a severe recession whilst trying to shrink their balance sheets and fight inflation and all crypto indicators point at further contraction as risk assets take a long-term hit whilst FUD gets new fuel to its fire with Binance worries.

It’s a grim picture painted, but at Pennings Alternative Investment Fund (AIF), we see nothing but high-yielding opportunity. The Penalyst is here to tell you why in this week’s edition.

I ended last week saying “As such, the Penning AIF team is heading into this week with a short bias”, and added the following updates with some highlighted price levels on LinkedIn. Anyone who saw those updates, read last week's edition of The Penalyst, and watched what happened in the market would wonder if Penning AIFs main strategy revolves around a crystal ball…

I highlighted my worries about the market expecting too much of a pivot from the FED, and this was just what we got. At the moment, the options market is pricing in rate cuts much earlier than what the FED is committing to through their updated, and still aggressive, dot plot. Additionally, the ECB fell in line with the FED, hammering home the narrative of fighting inflation at pretty much whatever social and economic cost.

BlackRock successively came out and said to expect a recession of unseen proportions ahead as a result of this and previous pandemic congestions still hurting parts of the market.

But the market was left with some confusion. On one hand, the FEDs median dot plot increased to 3.1% from Q3’s median dot of 2.9%, indicating the majority of the FED thinks inflationary pressures will last for a good 3 more years. Adding to that, the dot plot peaking at 5.1% shows the FED is ready to get really aggressive with rates, no matter what the negative implications this would add to the world economy.

On the other hand, Powell mentioned during his press conference that the FED was not ready to cut any rates until inflation moves towards the 2% target again with the dot plot indicating this happening in 2024. But looking at US CPI and how the FED calculates it, their own models would indicate a 2-3% CPI by summer 2023 and would as such imply rate cuts by then?

Additionally, Powell kept on using the language of “as of today” when referring to the FEDs estimates, potentially indicating that these estimations might be completely thrown out the window at any point as the underlying data changes. Some economists take this as a potential 25bp move in February already.

So there are no real conclusions to come to yet, and we will keep on seeing an indecisive market across all asset classes, with RISK OFF remaining the main narrative until enough data tells us differently. Just as we expected in last week's update.

BITCOIN (BTCUSD)

Last week's updates on BTC highlighted a pre-news move into a highlighted liquidity zone between 17800 and 17450 which was exactly what we saw. In relation to the news, we saw BTC move into previously highlighted resistance levels around 17819 and 18279.

Post-news, just as we expected, the market started to fade the positivity as the actual meaning of FED policy started setting in, and we saw the complete bullish run be reversed.

We settled around the already previously highlighted support level around 16700 and keep trading in a very narrow range there now.

Not one single metric is currently positive for the digital asset market with both BTC and ETH prices as well as trends being down week-on-week (WoW). ETH vs BTC ratio is trend negative suggesting the market is BETA driven in line with risk-off sentiments. Additionally, BTC remains dominant suggesting altcoins are underperforming, once again hinting at BETA-driven factors.

On the volume side of things, the global crypto market cap contracted WoW as well as trading volumes. Total Value Locked (TVL) decreased and the top 3 stablecoin market caps decreasing indicates money is leaving the crypto market for fiat.

All in line with our previous expectations and we keep holding a bearish bias, for now, looking for shorting opportunities in the market, short-term bullish moves to fade, and yield opportunities uncorrelated to market valuation.

From a chart perspective, BTC needs to set a clear and defined break of this 16700 level, preferably a clear daily close below, which would open up the way for a test of highlighted lower region support range.

On the upside, we need to regain the 200-hour EMA to even begin thinking of enough momentum to test the previously mentioned resistance levels.

As we head into the end of the year, we will see some portfolio rebalancing from TradFi funds, which can cause some odd moves in markets as volume dries up and short-term spark volatility increases. As such, my main approach would be to mainly stay on the sidelines until the second week of the new year, and any exposure one chooses to take until then would preferably be very short-term.

US DOLLAR INDEX

The US dollar index broke last week's highlighted momentum structure, crumbling out of the wedge structure, into previously mentioned support levels at 103.33. Once again, a call that almost played out to the dot.

The USD then regained some higher levels as risk-off crept into the market and risk assets faded from their initial bullish moves. However, the index remains pressured by the 200-hour EMA and I would expect some sort of consolidation over the next few holiday weeks.

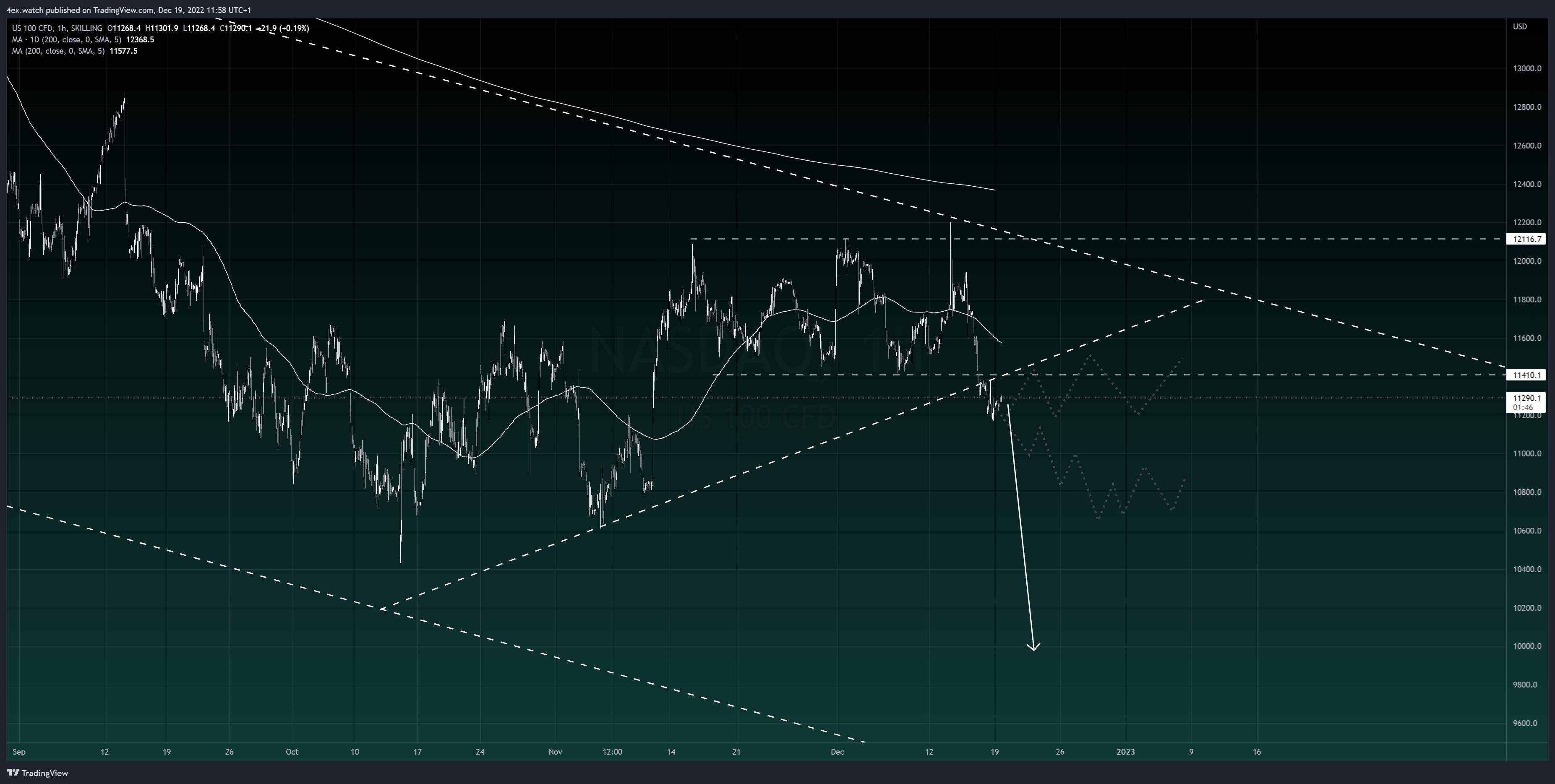

NASDAQ100

In line with the previously mentioned risk sentiment, the NASDAQ looks heavy, staying inside of its bearish structure, whilst breaking out to the downside of both horizontal range support and the channel wedge pattern. All were highlighted already in the previous report.

As such, further downside is to be expected, however, the actual breakout hasn’t been very momentum driven, so I do not expect any fast moves to the downside at this point in time. We will likely see similar developments as in the USD, with prices mainly consolidating into the new year, with the odd low liquidity spike happening.

CONCLUSION

To conclude, we had an extremely successful week last week in terms of the market playing out more or less exactly as we expected across the board. We are in a very data-driven market, and heading into 2023, until we start getting some fundamental data that truly starts supporting a pivot in central bank monetary policy, the main way forward will be to expect medium-term weakness in risk assets. As such, my main approach would be to stay more short-term in capital allocations into 2023 to be able to stay nimble and able to quickly adapt and position for the longer-term trends as they start presenting themselves. Something that could very well start to take shape already in Q1 of 2023.

The market is not aligning with the view of central banks, and as such, I believe it will be very clear very fast who’s on the right side of data, with the longer-term trends and market cycles taking form.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.