Inflation in the US takes a dip lower, signs of a soft landing for the US economy emerge, and risk assets rally. The digital asset market improves across several metrics, but one needs to ask themselves, where are bears caught off-guard? Or is this just a massive bull trap brewing?

Time will tell, but someone was willing to bet 4 billion USD on the latter. The Penalyst is here to give you his take on current events.

Last week's CPI numbers out of the US came in showing a cooling in the current high levels of inflation, sparking the possibility of the FED actually accomplishing something rather previously unknown, which is called a soft landing.

The exceptional monetary policy conducted over the last few years changed the global financial landscape forever, and as such one can only speculate on the future effectiveness of central bank policy. For that reason, the FED actually being successful in bringing down the economy in a soft landing might be a first, but not impossible.

However as mentioned before, the market is extremely data-driven right now, and we can expect equal swings to the downside if the data sours.

We have a decent amount of data lined up for this week, so a further advance in the current bull run or a downturn signaling a bull trap will most likely materialize this week.

At Penning AIF, we continue holding onto our core risk values of ADAPTATION and DIVERSIFICATION holding a rather neutral bias at the moment, still expecting the large-scale pivot coming in later this year.

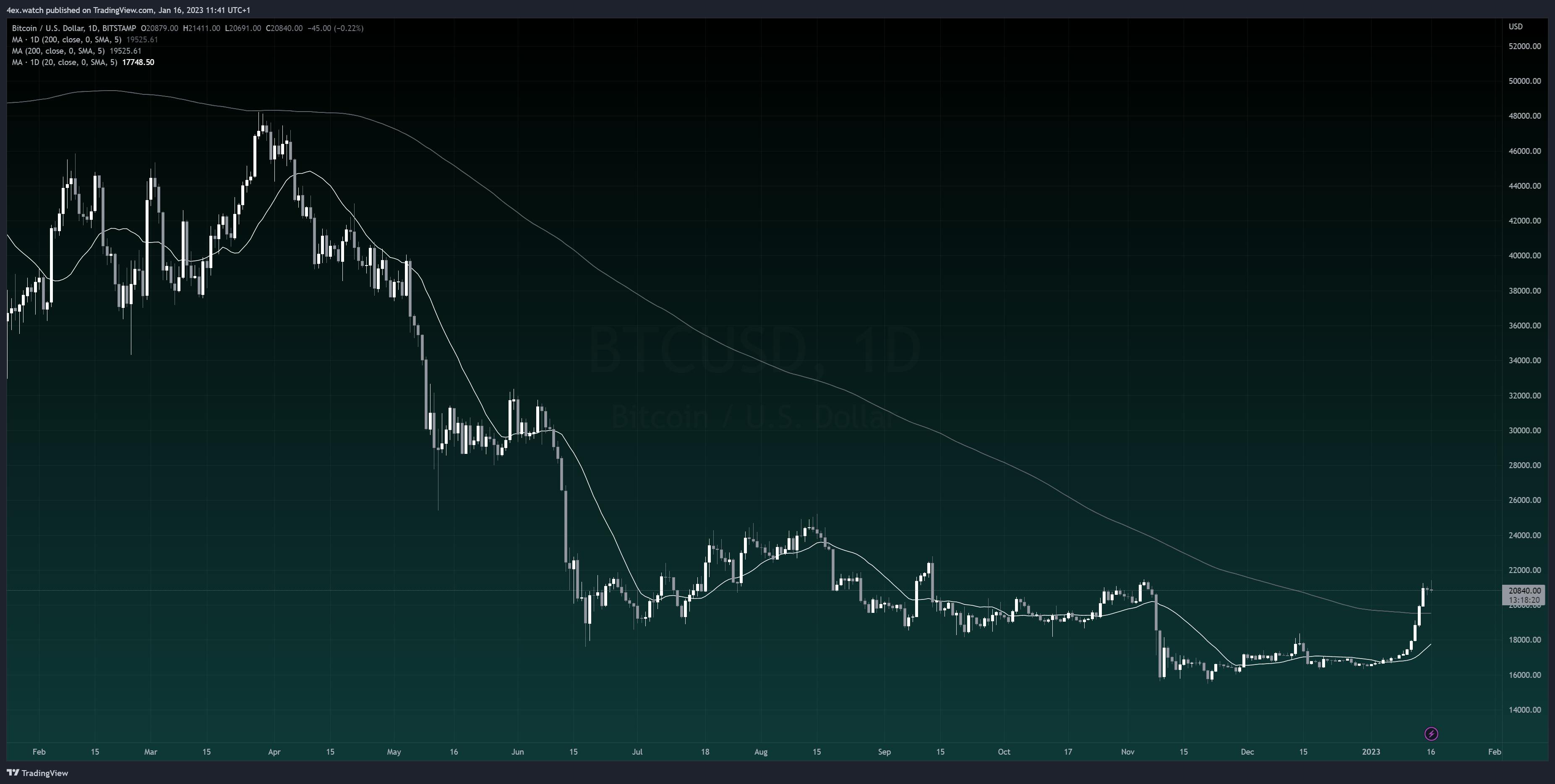

BITCOIN (BTCUSD)

This week we are going to take a more zoomed-out look at the BTC chart. Price has historically behaved the same when it comes to bear or bull markets, and it supports our current view of a larger shift coming later this year.

Previous bear markets have always been followed by a consolidation stage, which we haven’t had yet. This back-and-forth price action would evolve over a couple of months, and as such, we would expect this as our preferred scenario, whilst being ready to adapt if the data tells us differently.

Now in many ways, one could argue we’ve already had that consolidation over the last months, and whilst yes that is a valid argument to make, trying to time the exact bottom is a fool's game, and as such we will remain cautiously optimistic until further upside develops.

Something that can’t be denied, is the entry of a large-scale market participant a couple of days ago, where data shows an individual entity buying BTC long futures worth around 4 BILLION USD. Rumour naturally falls on Blackrock who have been talking positively about the digital asset space for a good amount of time now, and size-wise, this would be the equivalent of an institution of Blackrock's size dipping their toes.

With that said, we don’t think this will be a v-shaped recovery where risk assets just take off. We might be wrong on that, but as the chart suggests our preferred scenario of some more indecisiveness and erratic reactions to mixed data will continue to dominate for some time.

US DOLLAR INDEX

The US dollar continued its route to the downside, looking to test the lower bound support, not quite yet reaching it. This is in line with market correlations with the US dollar doing worse while risk assets do better.

The bias remains for a test of the lower support for a bounce from there to test support turned resistance from the previous consolidation, which by most likely will coincide with the 20-day moving average.

NASDAQ100

The Nasdaq respected the previously highlighted support zone very well and rebounded it, whilst staying inside of the larger scale downtrend channel.

A preferred scenario would be a slightly larger push to the upside to test the topside resistance of the channel, and maybe even peaking above it for a brief while whilst staying controlled by the 200-day moving average.

CLOSING COMMENTS

At the moment, market correlations are playing out very well, not only historically but the preferred scenario across all assets I go over in this report stays correlated in time and direction wise too.

But as mentioned, we do have a decent amount of news this week, so changes in sentiment can develop rather quickly. We haven’t seen a real pivot in sentiment, and we haven’t seen any true structural changes in markets just quite yet. Therefore it is important to not get carried away in the latest green numbers and it is important to highlight that we are yet to see several alpha-driven factors such as altcoins making structural new highs.

Add to that, it would not be uncommon to see FOMO hitting some segments of the market during these types of developments, and as such it is not uncommon that these players get into the moves too late, and at any hint of a downturn in price these players get washed out pushing down the market faster and more erratic as their (often leveraged) positions get liquidated.

So with that said, let me leave you with this. In my late teenage years, I was an avid martial artist winning several national championships and being part of the national team. As such, a big inspiration was the martial arts legend, Bruce Lee. And as with much else rooted in the deep philosophical side, there is a quote from Bruce Lee that I think applies very well to investing and trading.

“You must be shapeless, formless, like water. When you pour water into a cup, it becomes the cup. When you pour water into a bottle, it becomes the bottle. When you pour water into a teapot, it becomes the teapot. Water can drip and it can crash. Become like water, my friend.”

- Bruce Lee

Adaptation and Diversification. The two core values of Penning AIFs risk management. But put in other words, be like water, my friend.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.