On-chain metrics continue to indicate a contracting digital asset market but at the same time, we have fundamental developments in the global macro economy brewing beneath. A scenario that most funds and retail investors are missing. There is a massive short squeeze on the horizon, similar to the V-shaped bounce in equity markets we saw during the pandemic. And until that happens, digital assets are still showing resilience.

I've already talked about, over and over again, how I’ve not expected 2023 to provide the raging bull markets we’ve seen so many times before in digital assets. But rather a slow and technical grind higher toward my year-end projection of Bitcoin prices. And so far there has been no reason to change that view.

In the last report, I talked about hedge funds holding a massive amount of short SP500 exposure, and what this could mean for the markets. Now, that number has only continued to grow, and we have moved well into the pandemic (2020), EU debt crisis (2011), and the Flash Crash (2015) levels.

If you remember the remarkable short squeeze US equity markets provided in the pandemic, you understand the potential ramifications of such a large portion of the market being on the same side of the boat.

Market participants are still pricing in worries about high inflation and the US debt ceiling as major issues. But the FED, and more specifically Powell speaking at a FED conference in Washington, clearly indicated that the FEDs benchmark rate ”is high enough” and that this June meeting will most like be the first aft 14 months and 10 consecutive rate hikes that we see a pause.

It is my belief that this aggressive economic tightening will continue hitting the US and global economy hard, but not to the point of a global massive recession that market participants seem to be betting on right now.

The SP500 and the NASDAQ are both +10% and +22% so far, and we are seeing similar resilience in the price of digital assets too. Pullbacks are of course gonna happen, but so far they have been relatively shallow and in no way considered trend shifts.

So combined with what I spoke about last week, there is still a big chance of this massive short positioning ending up in a situation where it needs to be covered, fast. And when that happens, we will not only see equity markets pick up pace but also digital assets will follow along.

BITCOIN (BTCUSD)

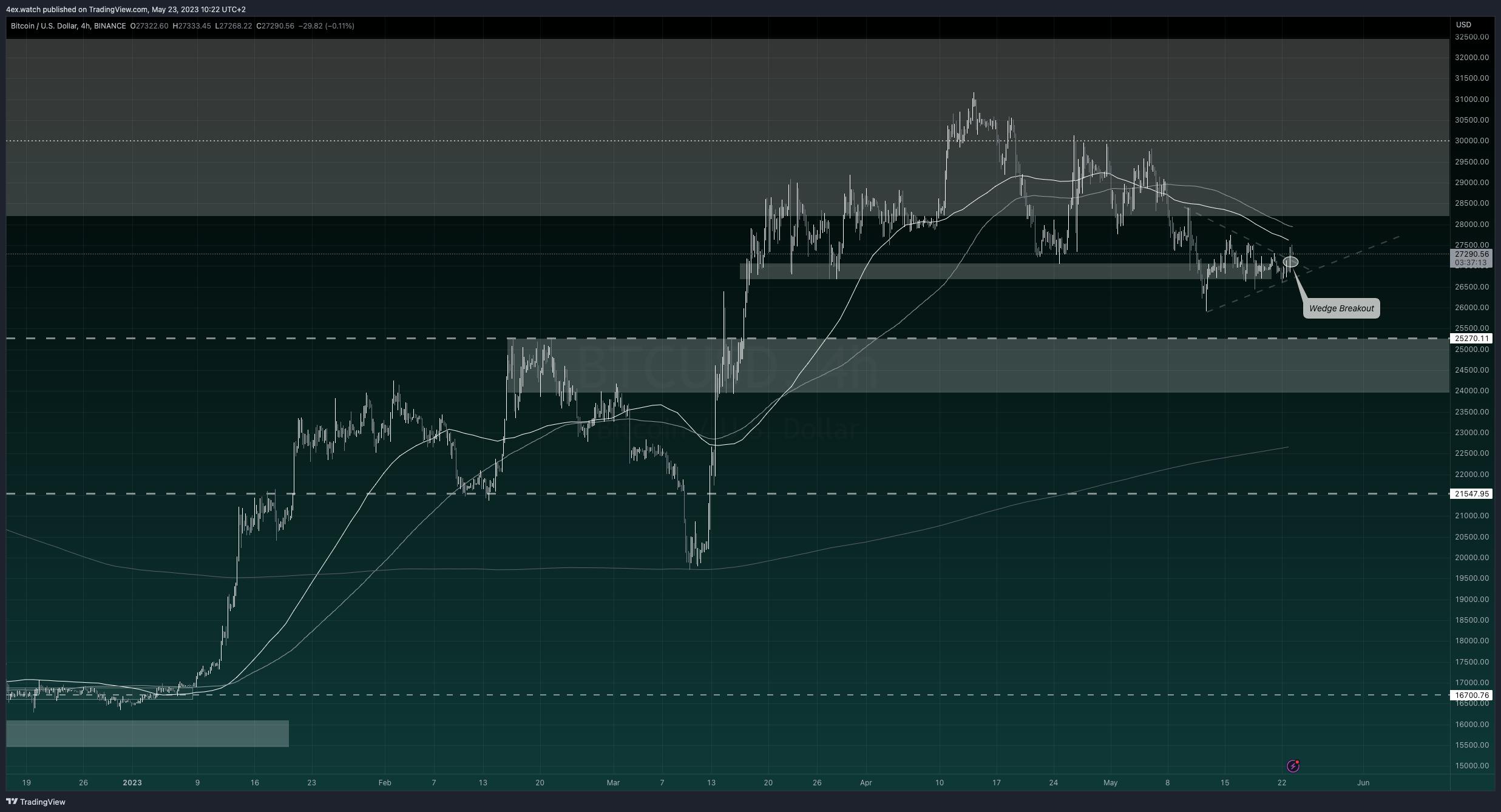

As mentioned, BTC has pulled back but is showing resilience value-wise considering the negative on-chain data clearly showing a contracting market.

The extent of these negative on-chain metrics actually has me surprised that BTC hasn’t visited the 25.000 mark and even sub this level with around 24.600 showing to be the main area of liquidity to pick up and propel a move higher again.

Instead, we’ve seen price form a technical wedge formation, and break out of this momentum pattern to the upside just recently. It is still a bit too early to determine the validity if this breakout, but if we can close outside of the wedge pattern for a couple of consecutive days now moving forward, a test and potential break of the moving averages is definitely on the table.

US DOLLAR INDEX

Another asset showing resilience is the US dollar. Last update I spoke about how the greenback looked ready for another beating, after printing red candles after red candles, but it steadily picked up from here and moved higher. Once again, making the BTC stability even more impressive, as this rallying US dollar easily could’ve pushed BTC down further.

However, my old FX trading genes tell me this bullish move in the USD is not necessarily generated by dollar optimism, but could rather be the sign of liquidity influx into the currency from both safe haven flows and risk appetite for US stocks. Either way, the expansion of available liquidity is proving positive for digital assets, so this greenback rebound is not currently worrying me but rather another sign of digital asset strength.

From a technical perspective, this latest USD rally is showing some rather massive bearish divergence, so when this thing breaks to the downside, we could be in for some fast moves.

NASDAQ100

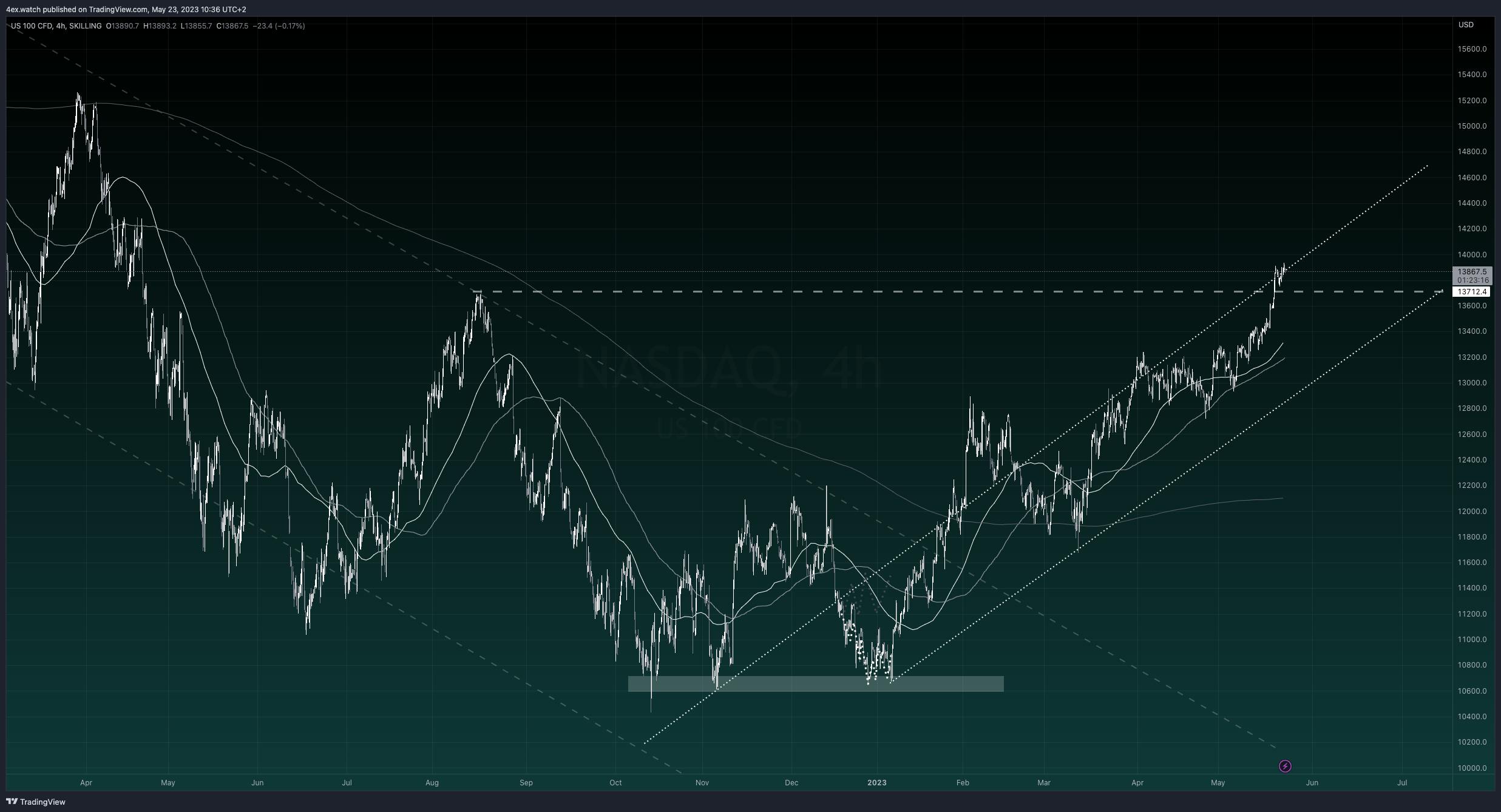

As mentioned at the beginning of this report, the NASDAQ is on a complete rocket launch higher and has just recently overcome previously highlighted resistance at 13712.

The bullish trend remains strong, even still with room for rather significant pullbacks and still remaining in bullish territory (highlighted upwards trend channel).

A chart that does not go hand in hand with hedge funds massive short positioning.

CLOSING COMMENTS

So now I think you see the complete picture. Digital assets and BTC especially, showing some incredible strength all things considered. You just have to look beyond the chart. And adding all these factors together, I am highly surprised we haven’t visited sub 25k in BTC. What’s going to happen once pandemic volume levels of equity shorts start being covered?

Stay up to date by following The Penalyst.

- The Penalyst