Markets played out to the dot as we expected last week with Bitcoin showing strong signs of resilience and breaking out of its technical wedge with confidence. We are now entering some strong seasonal patterns that could very well play out and push this narrative higher.

The NASDAQ - Bitcoin correlation seems to reestablish itself again to some extent, and that aligns with us just moving into a strong seasonal pattern for both assets.

The 3-month window of June to August has on average added +8% for NASDAQ investors over the last 10 years. Add to that, July historically being one of the year's strongest months for Bitcoin, averaging returns of +11%, and the total for June to August coming in at +23%. Let us see what this year holds, but this would be very much in line with my previously expressed view of current risk sentiment, and the push higher for Bitcoin to reach my year-end prediction price.

BITCOIN (BTCUSD)

BTC did break out of the technical wedge with confidence and hasn’t looked back since. Both moving averages have been taken over by bulls, and we have seen prices make a temporary pullback as we re-entered the large liquidity zone.

I would expect the 30.000 level to be tested in the near future.

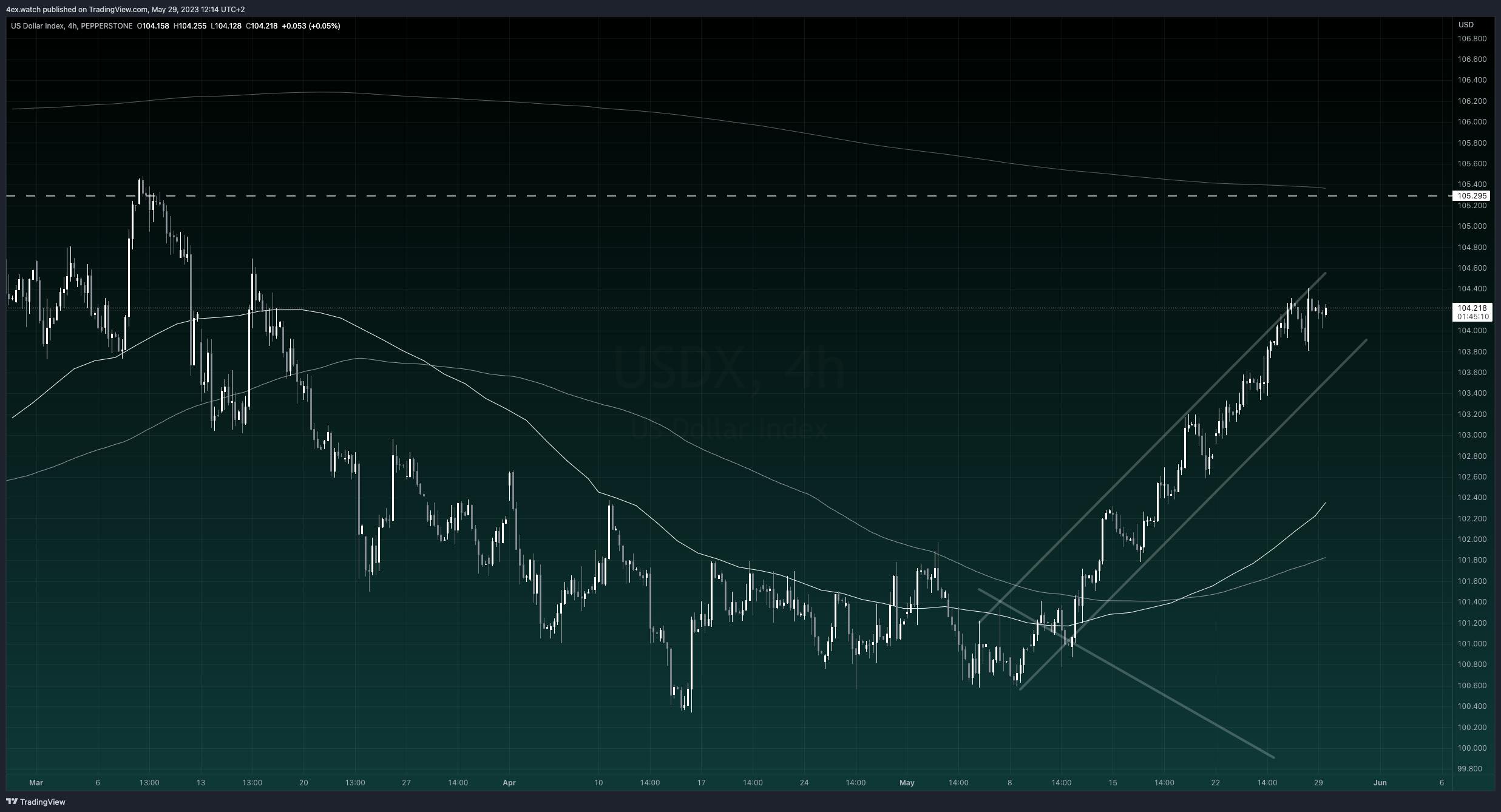

US DOLLAR INDEX

The greenback continues its push higher, with a clear channel to track.

We can pull back quite deep from here and still remain in the bullish trend, with a pretty steep fall height to both the lower bound of the channel, as well as the bullish support of the two moving averages.

The US might make a full push into the 105.50 highs before turning lower but this one is a little bit tricky to judge right now.

However it does not seem to have too much of an impact on the price of Bitcoin for now, so as long as that continues, I don’t mind the greenback outlook remaining a bit cloudy.

NASDAQ100

The NASDAQ is showing similar signs to the US dollar, with a clear bullish channel to track, but prices have just now recently broken out even higher. I would consider it overbought at this point in time, so a pullback is expected. But just as mentioned with the greenback, we have a long way down until the outlook turns negative, so I would consider pullbacks as technical liquidity grabs, rather than a change in the general outlook.

CLOSING COMMENTS

The theme seems set for the US dollar and the NASDAQ. Pullback then higher would be expected in the near future. How deep of a pullback one can only speculate. In either way, Bitcoin remains well supported technically and fundamentally with everything remaining in line for three strong summer months for the digital asset to continue higher.

- The Penalyst

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.