Central Banks across the world are pivoting, although not the pivot markets were expecting. Rather than a pivot in interest rates, we see a pivot to data dependence. The market remains a bit stunned by this, and volatility is expected to come in bursts as data moves sentiment.

In some ways, it’s like we are back into the Trump era, but instead of shotgun tweets splattered across the marketplace, we now have a wide arrange of economic data, from all the large-scale economies that constantly need to be monitored and interpreted. I’ve said it before and I’m gonna say it again. Diversification and adaptation remain the name of the game.

On-chain analysis continues to show us improvements in metrics, suggesting a mathematical and data-driven shift in sentiment. For example, Bitcoin Profit/Loss ratio has turned positive from previous very low levels, with sharp upticks from negative territories after a prolonged period of negativity historically indicating the beginning of decently sized bull moves. However, it is worth pointing out that many of these on-chain metrics resemble the ones we saw in for example 2015 to quite a large extent, where we consecutively had around a 12-month period of sideways movement before markets really took off. As such, caution is advised to not get caught in bull or bear traps going forward.

BITCOIN (BTCUSD)

BTC has shown some pullback, which was expected as mentioned in the previous report. The price tested the 24.000 level before rejecting and now giving up the short-term Moving Average, and now sitting tightly into resistance turned support.

As long as the 200-day MA holds, the longer-term trend remains to the upside, however, this has turned rather neutral, with our proprietary predictive models showing projections of a slight bearish turn.

Everything revolves around Central Banks and the data they are watching at the moment. This week we have a big one, CPI out of the US, so I wouldn’t be surprised if this will be this week's catalyst to push BTC higher or lower.

To the upside, we need to take out 25.270 resistance to really get going into the 30.000 area, and to the downside, I’m not turning bearish until the 200-day MA gets taken out, which would open up the door for the setting of a new lower low.

US DOLLAR INDEX

The US dollar is sort of at a make-it-or-break-it point, with the price sitting between the short-term and the long-term Moving Averages. Very indicative of general market sentiment right now.

Are we setting in a temporary low, for a rally toward previous highs? Or is this just a short-term relief rally before we flush out the lower horizontal support for a break below 100? This week's CPI reading might let us know.

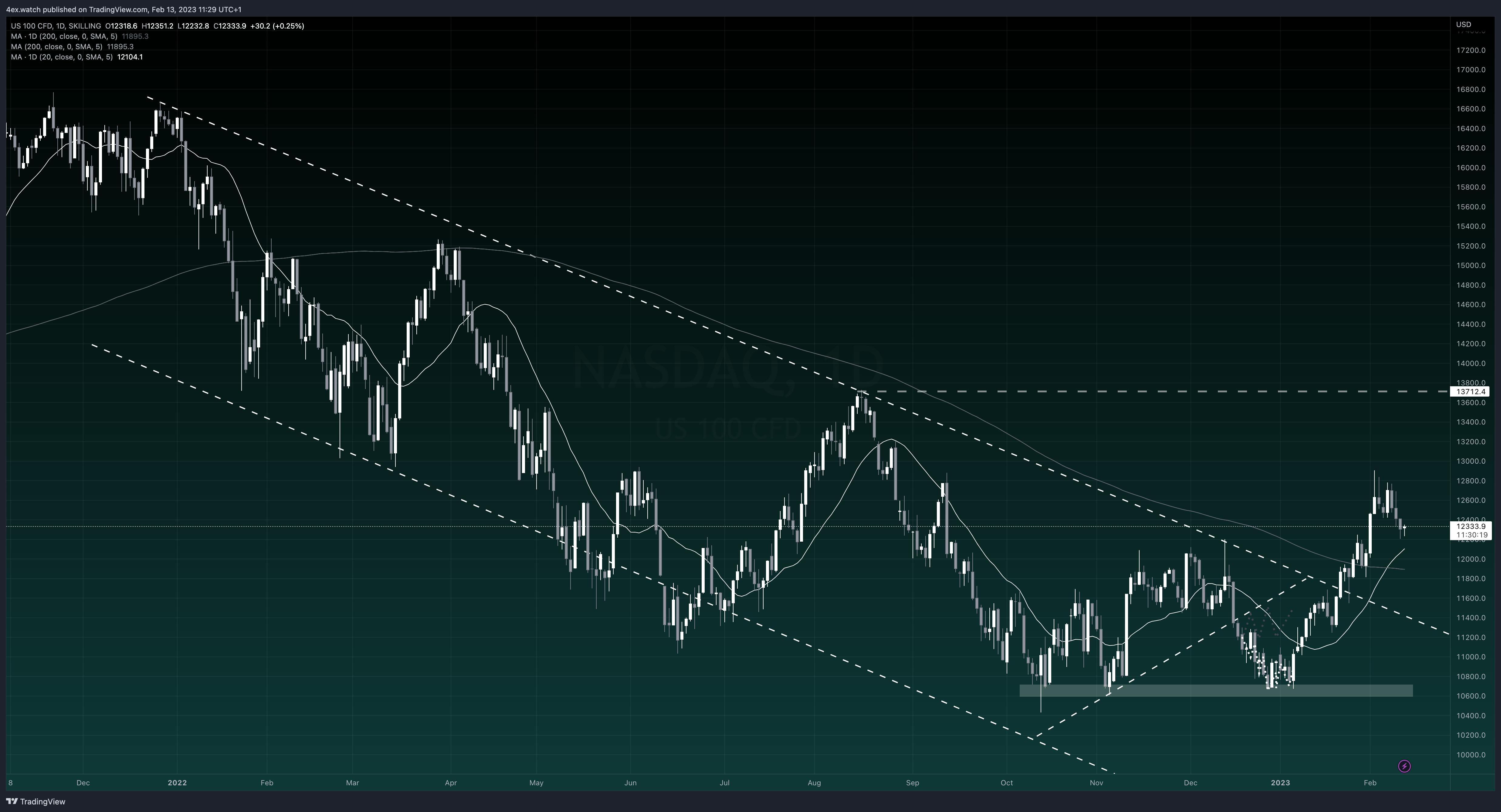

NASDAQ100

The NASDAQ has broken out well out of its bearish channel and put in a couple of days' pullback over last week. Both short-term and long-term Moving Averages are holding tho, so until either breaks, bias for more upside remains.

A run towards the previous high of 13.712 would indicate a significant trend shift on the higher time frames too and open up the road toward the 15.000 level.

CLOSING COMMENTS

The market is waiting for a catalyst, and this week's CPI might be just that. If not, expect some broader sideways movement and keep an eye on the underlying metrics for clues on future direction.

No matter what, Penning AIF remains vigilant and ready to capitalize on the moves.

Our approach of diversification and adaptation proved fruitful in January, closing out the month at a realized return of +9.15% and an unrealized return of +30.21%. The full performance review is available on LinkedIn and upon email request.

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.