Silvergate news puts a dent in the brewing crypto rally as we head into the last month of Q1. And oh what a month we got ahead of us. The following three weeks are being labeled as ”the 3 most important weeks of H1” by trade desks across the world and Pennings Head of Fund Management, Timothy Hellberg, is here to tell you why that is, in this week's edition of The Penalyst.

Oh boy, oh boy. No other segway felt appropriate to begin this week's deep dive into the financial markets and the volatile world of digital assets.

Just as an experienced sailor watches a storm forming far off in the distance, the team at Penning is preparing for the three coming weeks.

I’m not gonna spend to much time on what all of you already know. Yes, crypto pulled back. Yes, the risk asset correlation between stock indices and crypto is currently off. And yes, news of Silvergate imploding and the issues for USD fiat transactions this already seems to be causing is not doing anything good for the markets.

However, if you zoom out, this is just noise for now, and pullbacks are still holding within a broader bullish sentiment. So what is actually on the agenda for the next three weeks?

Well, we hit it off with Powell testifying before congress but this is a special one. The way the latest data has come out of the US, traders across the world won’t be listening to what Powell says, instead, they will be listening to what he DOESN’T say. Big difference.

As long as Powell does NOT hint or signal the possibility of a 50bp rate hike, risk assets will most likely rally into Friday's jobs report. Comments along the lines of ”hiking for longer”-the theme will not be enough at this point in time.

On the other hand, if Powell actually does make such hints, we are going lower. Much lower. Across all risk asset classes. It would quite frankly be a bloodbath.

Then, the week following, will be the start of the so-called” blackout period”, in which FED speakers aren’t allowed to comment on the policy until after the next rate meeting. As such, we pretty much only have a small window of 14 hours on Friday between NFP and equity market close, for FED speakers to make any real comments.

When US CPI hits the markets next week, FED speakers can't comment on it. But important to note is that we always run the risk of The Wall Street Journal for example running a story based on ”FED sources”.

And after that, we obviously get the actual rate decision. So the following weeks are incredibly significant for setting the whole foundation of how we go forward. And with where the world of digital assets stands, we are balancing on a thin line between the market imploding on itself, or reaching new highs.

So as I said. Oh boy, oh boy.

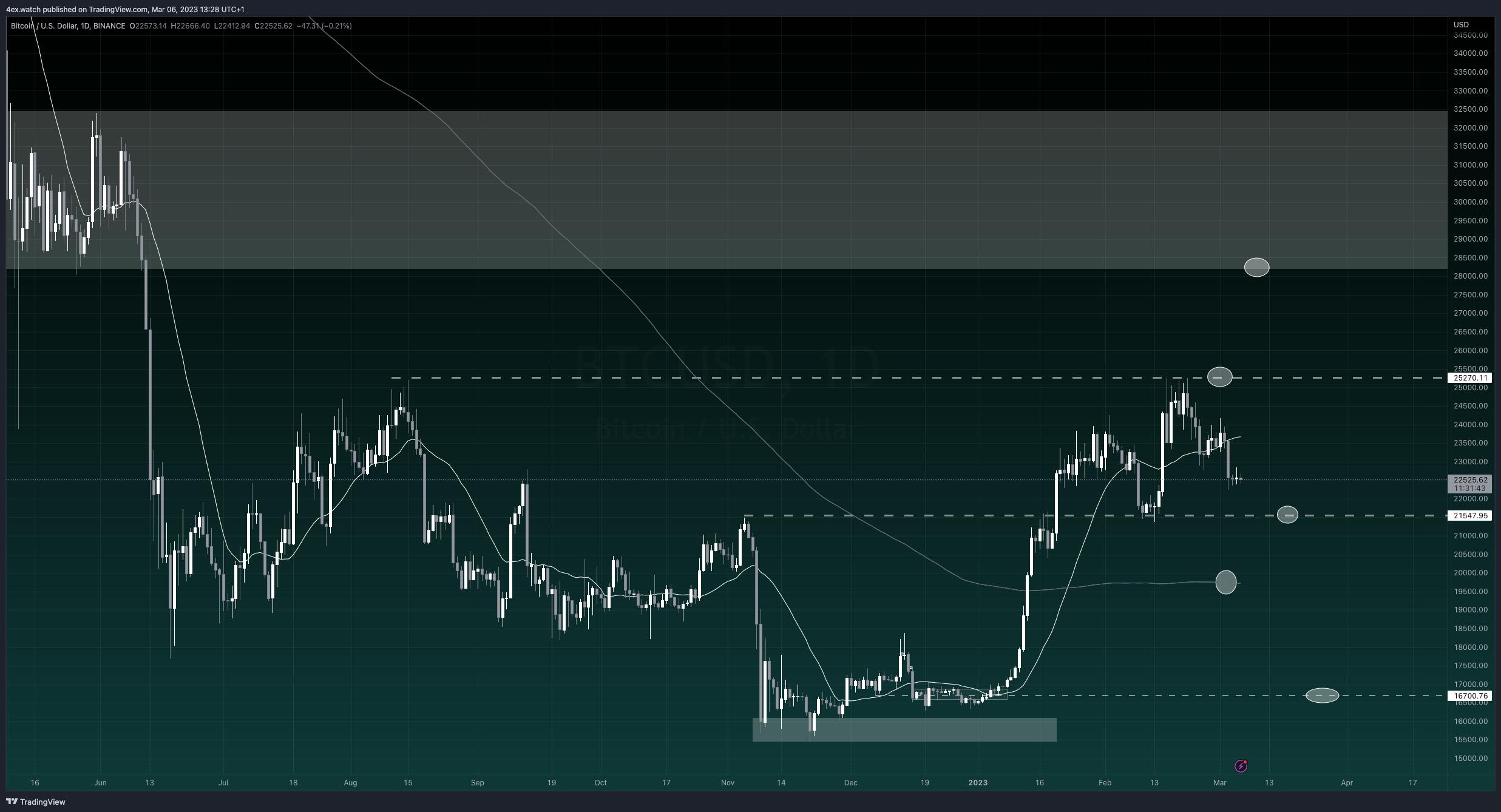

BITCOIN (BTCUSD)

Most on-chain metrics are turning short-term bearish for BTC, as one would expect after the latest downturn in valuation. However, like I’ve pointed out before, the 200-day MA remains the line in the sand of any real structural change in sentiment. If we zoom the chart out a bit, it becomes quite clear that we have basically only formed a larger consolidation structure, between the lows, and capped by the 25k top for now. The 200-day MA acts as almost a sort of median value, floating neutrally right in the middle of the range. Additionally, we have horizontal support/resistance running through the middle of the zone, so going higher or lower inside of this structure doesn’t mean much in the big picture. Levels remain the same, as well as possible breakouts and their consequences, from previous reports.

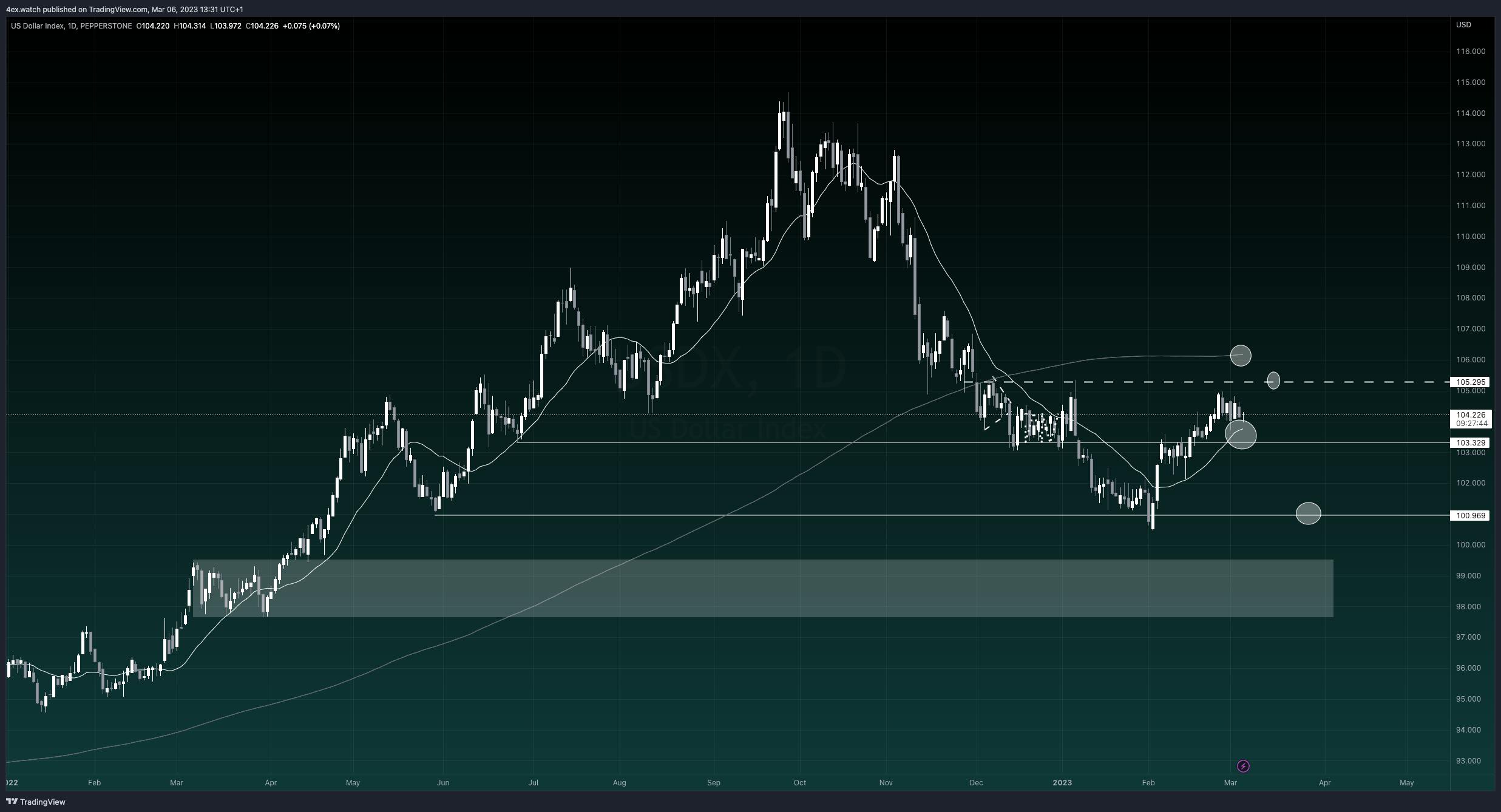

US DOLLAR INDEX

As I mentioned last week, the US dollar put in a strong daily candle, and we slowly trickled down from it, with not much happening. Also here, levels and consequences of breakouts remain the same from previous outlooks. Expect the outcome of the next three weeks to be pivotal for the USD too.

NASDAQ100

The Nasdaq is currently hovering around the short-term moving average, but as mentioned at the beginning of this report, my preferred scenario would be to see indices rally into this Friday. As such, around 0.5-1% higher in the Nasdaq is very much on the cards here. Now as mentioned, last week's stock rally didn’t spill over into digital assets due to the Silvergate news hanging over that market, so keep an eye on if this correlation picks up again. If so, the value of BTC does not represent fair value in correlation to the Nasdaq and as such, either the Nasdaq needs to pull back with BTC not doing much, or BTC gaining some value with the Nasdaq standing still or pulling back. Levels remain the same from previous reports.

CLOSING COMMENTS

From a week of not much news on the docket, the calm before the storm if you want, to three weeks of volatility and make-or-break pivotal points in the market. I have been warned of the risk EVERY. SINGLE. REPORT. We are not out of the woods yet, and there is no need to overleverage and FOMO into the market. I’ve tried to make this very clear, and as anyone of you who have read the performance reports of Penning AIF, we remain liquid in the fund's investments, not having allocated fully in ANY investment segment. Adaptation and diversification. You have two questions to ask yourself. Are you positioned in a way where these swings in the market don’t keep you up at night? And maybe more importantly, are you liquid enough to pounce on any REAL value opportunities presenting themselves in the volatility that is coming over the next 3 weeks?

Penning AIF sure is.

-- The Penalyst