As seasoned investors get 2008 flashbacks, a new banking crisis shows its ugly face to the global financial markets. And as the dominos start to fall, they get bigger and bigger spreading fear across the board. However for the digital asset market, there is a silver lining to what’s going on right now, and The Penalyst is here to tell you how and why.

So I highlighted these weeks a couple of weeks back, as highly volatile and as a reference point for how the market would move forward. And that is surely what we are seeing.

I also posted our special report a while back, talking about ”The Crypto Spring” which seems to now really gather some momentum and melt away the fears of the cold and long crypto winter we now are coming out of.

And this paired with the still high uncertainty glooming across markets, we see what could best be defined as ”a flight to quality” with Bitcoin being the largest winner.

One could almost wonder if we cracked out the old crystal ball again, with the market moving very much in line with our broader analysis of developments, as well as our more narrow analysis of the actual charts, with Bitcoin moving very well as per highlighted levels for months now.

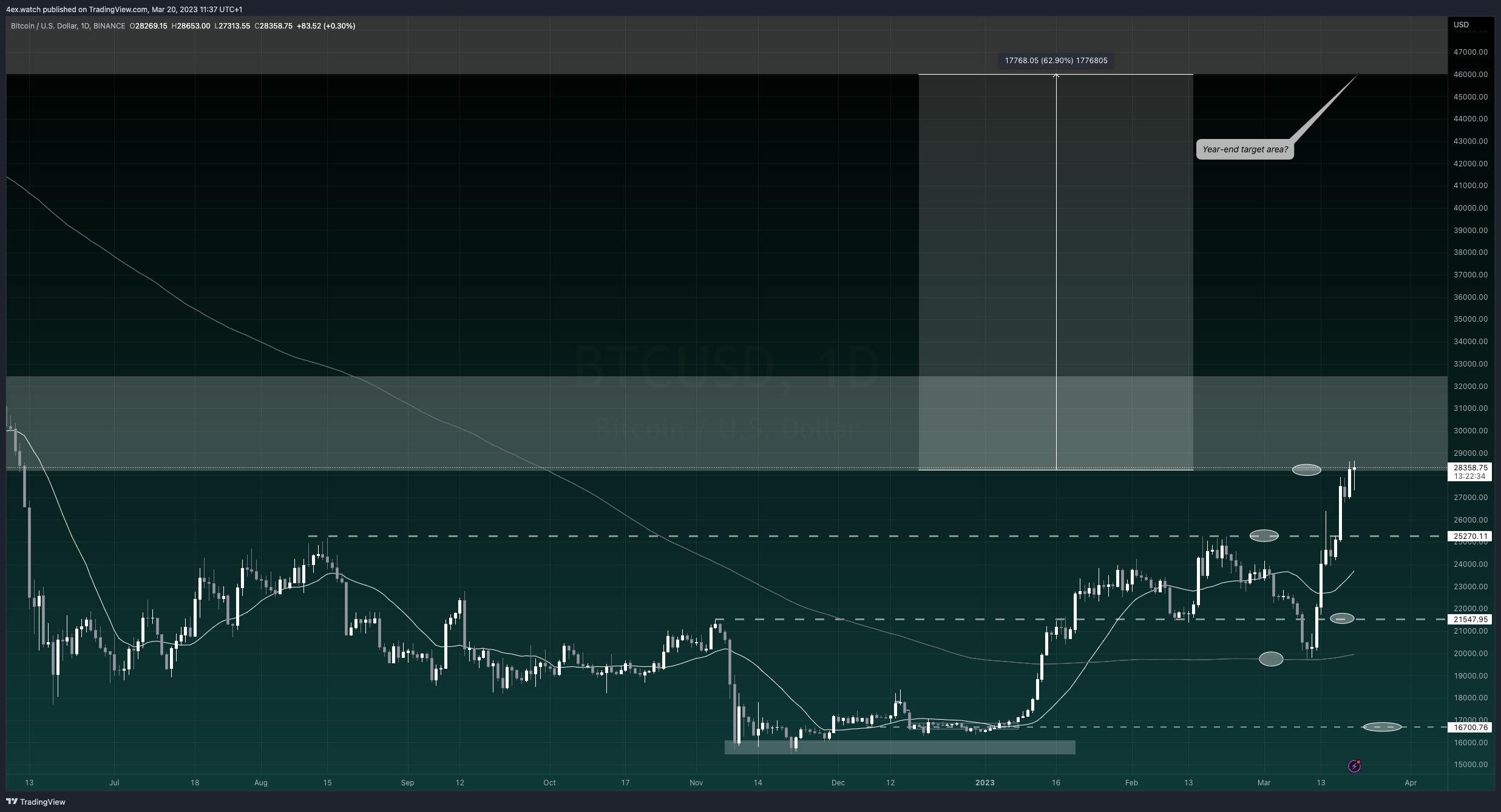

BITCOIN (USDC)

As I mentioned in a LinkedIn post, done a couple of days ago, the FED last Monday commenced a sort of hidden QE that hasn’t been widely reported about. And now, during the week, further news brokers of all the major central banks coming together in further easing operations to try and steer clear of a worldwide banking crisis.

As such, we are seeing fresh liquidity coming into the system, which is an absolute core necessity for such a young financial ecosystem as the world of digital assets to be able to expand.

As a consequence of this, we saw Bitcoin do a firm and decisive break of the 25k highlighted level, which opened up the way for a test of the 30k liquidity zone that ranges between just south of 28k and just north of 32k.

The market needs to be able to digest the demand, as well as the influx of new liquidity at these levels before we see a push higher. However, a test of the upper band of the zone around 32-32.5k in the next months is very much on the table.

It’s still a bit early to make any year-end projections, but with if the market continues developing in this manner with almost a perfect trifecta of factors for BTC of added liquidity combined with a flight for quality as well as a weaker dollar, I wouldn’t mind holding the area between 46k-50k as a possible year-end price.

To the downside, we are not supported by resistance turned support at 25k, as well as both the short-term and long-term moving averages.

US DOLLAR INDEX

The US dollar is not fairing well with this new injection of fresh liquidity. It is not only through the operations carried out by the FED, but the joint statement of central banks across the globe specifically mentioned their liquidity operations being USD nominated and targeted, as such the USD taking even a further hit.

Although we might still see short-term fluctuations, this development should have us seeing the USD gradually decline, and a test of the 101-100 level in the not-too-distant future is very much on the books and I would expect a full extension into the 99.50 - 97.70 liquidity level in the following months.

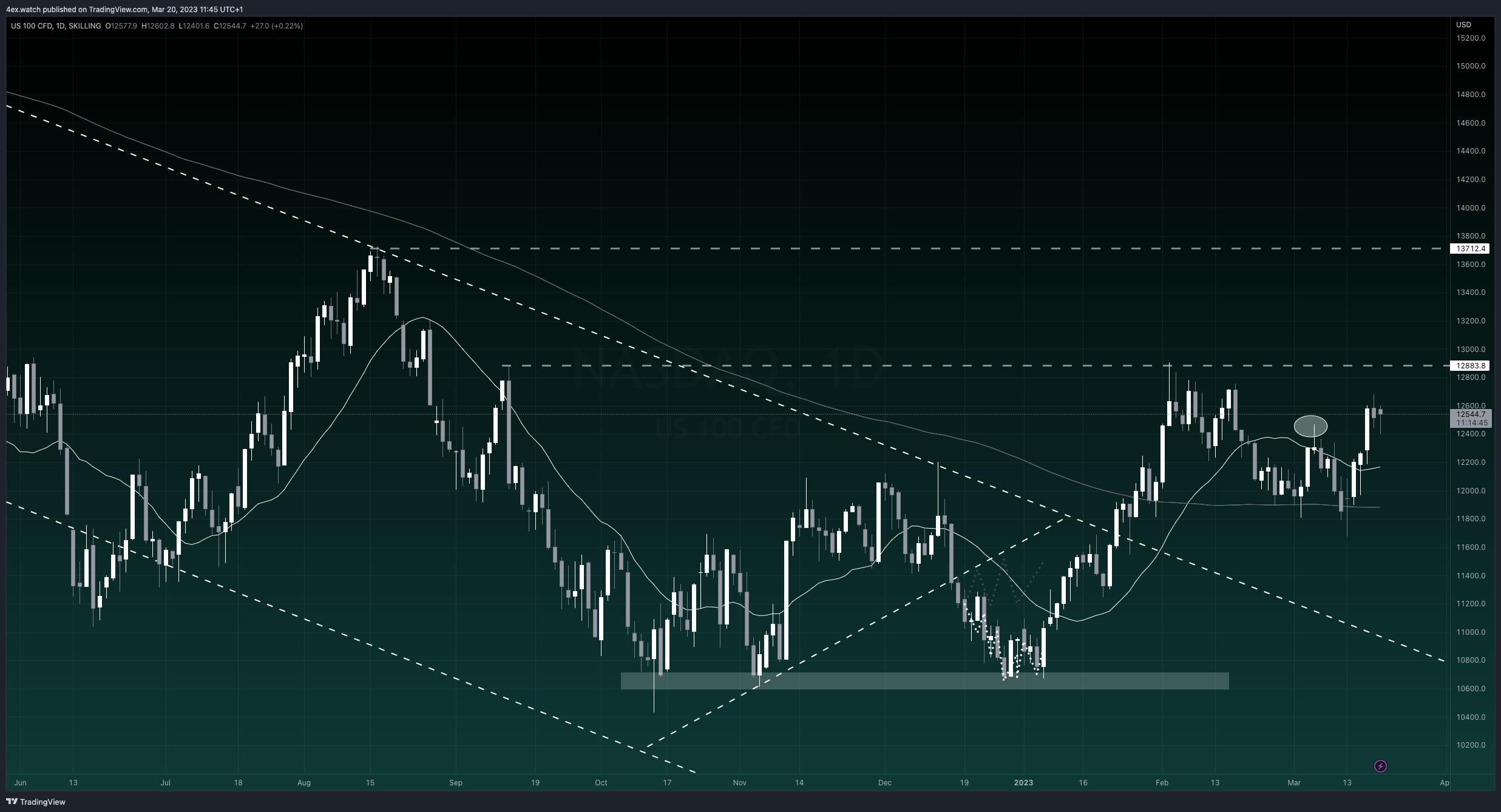

NASDAQ100

US tech stocks are looking constructive as per the latest developments, although I would be careful with further direction as we are yet to see what weighs the most for actual corporate earnings here. Will the injection of new liquidity be beneficial enough that a majority of companies benefit to the extent that it offsets the issues of higher interest rates, burning inflation increasing all producing costs as well as general recession issues? It’s too early to say, but I would be inclined to say no, not as it stands now.

However, this isn’t as important as it used to be, because as I’ve highlighted before how markets have developed the Crypto - Nasdaq correlation has not been working very well lately.

CLOSING COMMENTS

The world of digital assets is starting to cement itself in a rather new position that is increasingly interesting for the financial markets across the world. Really beginning to carve out an independent and defined place in the market is attracting more and more professional money, seeing a paradigm shift in what digital assets actually can provide.

The days of moon boys and degen gambling will still exist in the low liquidity meme coins, but the general market is making a turn into more complex, low-risk high-yield products with the tokenization of assets growing exponentially.

And this is a part of the market that Penning will pioneer over the coming years.

- The Penalyst

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.