The dominoes of the developing global banking crisis keep falling and getting bigger and bigger. All while the US dollar is losing both value and status while US policymakers show how fragile and erratic banking regulation and guarantees are. And in addition to that, money flows show some interesting signs, that could lead to 30k BTC within the next couple of weeks. The Penalyst is here to tell you why.

There are some interesting themes going on in the markets at the moment. Inflation worries have been replaced by a growing banking crisis, and it’s becoming increasingly clear that the traditional financial system is still very fragile and affected by policy and regulation. And in times like these, just policy and regulation seem to be made up on the whim.

Let me give you an example. Janet Yellen last week first said that the US government was NOT going to provide blanket insurance to bank depositors, however, she instantly pivoted that by saying that further measures were discussed. But just think of that for a second. About 40% of deposited funds in the US are not eligible for protection at this point in time. That’s trillions of US dollar the US government are just going to blanketly all of a sudden backstop and guarantee?

That’s an immense policy action to undertake. Almost as crazy as printing billions upon billions week in and week out without thinking of the long-term effects during a global pandemic. Oh, wait…

This solidifies the space of digital assets more than ever, as these types of “on the whim” major policy changes can’t be incorporated into a binary decision system.

This, along with last week's mentioned aspects, and some new ones further into this report, is pushing BTC higher.

BITCOIN (BTCUSD)

We are seeing some very interesting money flows at the moment. During Asian trading sessions, digital assets are being sold off, for the benefit of moving into distressed securities and lower-risk assets at the moment. However, when the US comes online, the demand for crypto picks up massively with both retail and institutions wanting to both move away from TradFi banks to limit baking risk, as well as from a pure speculative perspective. The Asian session supply gets easily gulped up by the US session demand. This is a beautiful market dynamic that is currently working very well in favor of higher BTC prices.

On the technical side, previous levels remain the same, with prices knocking on the current liquidity zone, which I expect we move further into, and would be prudent to add any long around the 30-32k area.

US DOLLAR INDEX

The dollar is getting hit from several fronts, not only the macro outlook. In FX markets, you trade everything relative. To determine the value of US dollars, you need to price that value in another currency. And the big counterpart to the USD for this is namely the Euro. And the euro has been on quite an amazing bull run lately.

So you are seeing from a relative value perspective other currencies provide more attractive storage of value than the USD, making money flow out of the USD and into other FX, pushing the USD down, which also helps the price of BTC rise relatively.

NASDAQ100

The NASDAQ is proving a bit of a tougher nut to crack, but as highlighted before, the US tech correlation to digital assets is not what it used to be.

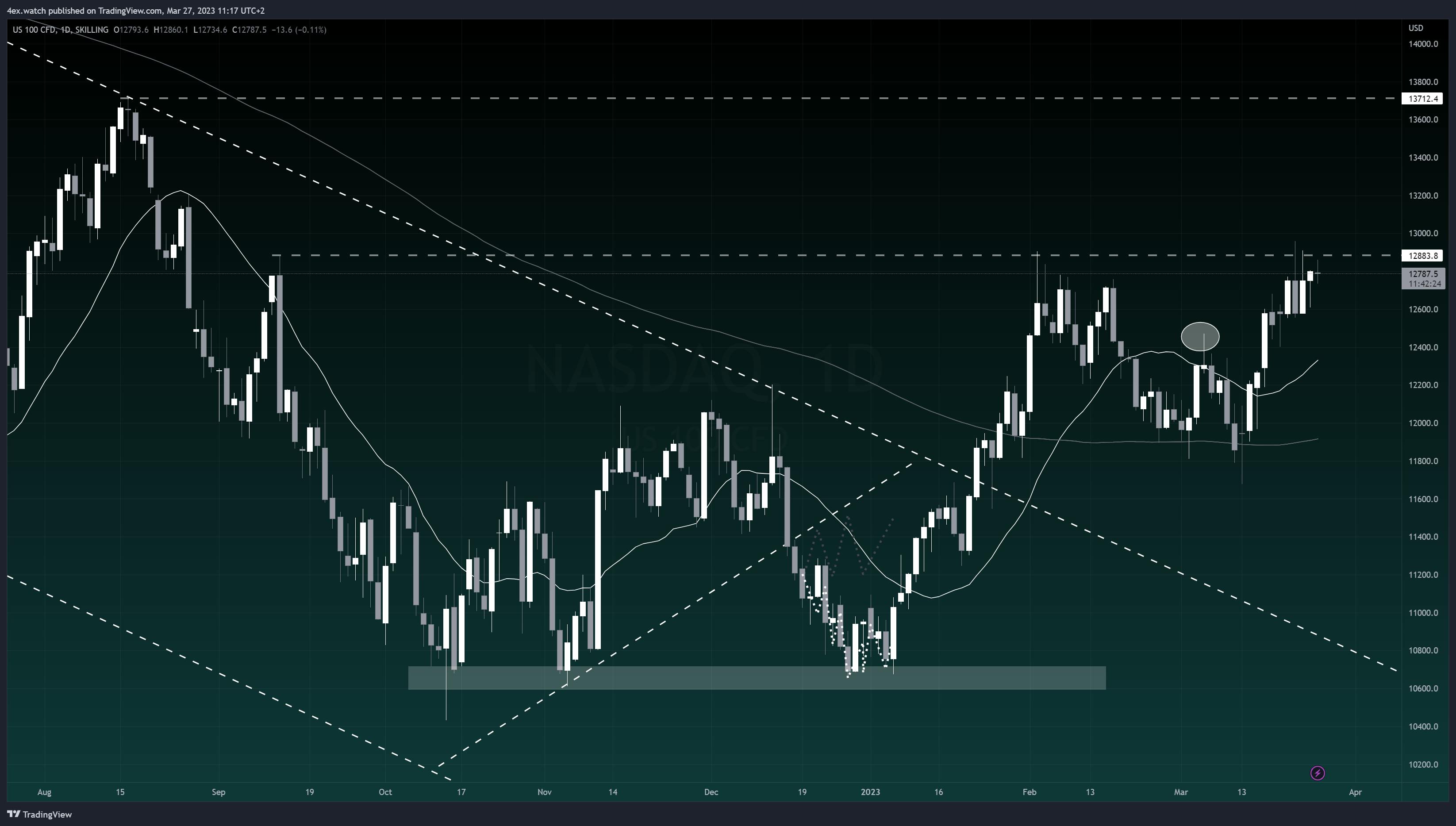

The NASDAQ was able to rebound higher but has been capped by a double top forming around 12883 which is an older level of resistance I’ve been highlighting for several months now before the tests even began.

This area when zoomed out is a pretty shallow rebound, which doesn’t offer any high conviction. We need to see this level be confidently overtaken, until so a move lower first for a test of the 200d moving average seems more likely.

However, we are moving into the quarter end, and fund managers will want to show clients the “correct” holdings on their balance sheets, and this combined with the previously mentioned Asian buying of TradFi assets could very well be just the catalyst that US tech stocks need to break higher.

CLOSING COMMENTS

So with all of that said, I am expecting the 30-32k area in Bitcoin to be hit, maybe as fast as mid this week already, and price action there will be key into the new month and the new quarter.

- The Penalyst