Bitcoin breached the big 25k level, all whilst moving in ways making one wonder if The Penalyst once again cracked out the old crystal ball. But what has fueled this rally? And what are the on-chain metrics telling us about the future? Join us in this special edition of The Penalyst, where we go through the signs of a crypto spring starting to show its face between the coats of ice and snow layered in the crypto winter.

As Bitcoin leads the march, the world of crypto has kept rising since the start of 2023, and as the big level of 25k in BTC has broken, there is a lot of speculation as to where we are going from here. But before gazing into the future, one needs to understand the past and how we got here. Because it’s rather complex to understand all the current factors driving the Bitcoin rally.

Unlike in the early beginning of the year, when the start of this move was fueled by a rather massive short squeeze initiated by institutional capital flows, the latest moves have much more depth and momentum behind them.

In this special edition report, I will try to make all the historical factors as easy as possible to understand, while also looking at current forward-looking on-chain metrics that give us clues about what the future may hold, and why we believe that the first signs of a crypto spring are showing.

INSTITUTIONAL MONEY - BIG GUYS WITH BIG GUNS

As I’ve already touched on this, I’m not going to go too in-depth on the subject, and mostly let the attached graphs do the talking.

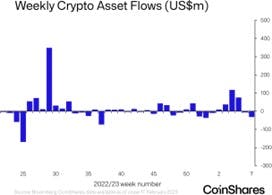

Although we’ve seen some profit taking the last weeks from institutions, this was well expected, especially as market-moving news where on the docket, and by comparing institutional flows into crypto with total assets under management (AUM) the numbers tell a clear picture: institutional headed into the last two weeks with strong gains on their holdings, so seeing some capital outflows from realizing profits was expected.

Nonetheless, the institutional flows into crypto, and especially BTC, show that the big boys are here to play, and not just for the short term.

Specifically, institutions targeted short exposure in the market, as such adding long exposure drives prices up.

And addition to that, the general idea of institutions joining in more and more is something taken as positive for the general market sentiment too, further helping to fuel the rally.

CBDCs - BLUE PILL TRUST

We’ve all seen the headlines of central banks across the world starting to roll out pilot programs for their CBDCs, with Russia and Japan being the latest Central Banks to make announcements. And no matter what your take is on the subject by itself, central banks are THE largest liquidity providers in the world.

Although the liquidity doesn’t directly enter the market in the more traditional ways, it’s still the case of a huge improvement of functions and awareness for the whole crypto ecosystem.

Central banks are viewed by the general public as the highest institution of trust and security, so they are absolutely key in the way crypto is going to be more widely accepted and understood by the general public. And if you’re a crypto novice, naturally the first thing you think about when hearing crypto is Bitcoin.

So this all ties into this magical word I keep using. SENTIMENT. The more Bitcoin and crypto get spoken about with a positive tone, by trusted actors, the more sentiment improves.

We are beyond ”moon boys” and meme tokens. The fundamental future of the crypto market is being formed, and it’s being done so on a very strong base with actors like Central Banks and financial institutions being part of the discussion in such an early stage as this expansion cycle still is in.

THE DIFFERENCE IN MINING MANAGEMENT & BTC HALVING

So now, we are getting a bit more into the crypto technicals. We have a BTC halving coming up, and the market participants that it impacts the most are miners. The miner's action in turn affects the general supply of BTC, and as such the valuation as well as the broader market is affected.

Typically in bear markets, as the crypto winter we seem to be coming out of now provided, miners struggle with profitability. However, this bear market was different. We saw nowhere as much capitulation from miners, but not only that we also saw the ones capitulating rather than getting taken over by other miners than just ”blowing up” and removing their market participation.

So it seems the mining industry is now another sector of the digital asset space that has become more efficient and can navigate the cyclical nature of the ecosystem with less constraint and negative effects on operations.

So with that said, the upcoming BTC halving is therefore unlikely to negatively affect miners as much as the previous halving. And what that exactly will mean for the market is still a bit too early to speculate on, but theoretically, a more effective mining industry should mean a less negative effect from the halving, and as such a larger focus on Bitcoins deflationary effect from the halving and increased long term value.

With the growing influx of institutional money into the market, it isn’t farfetched to think these institutions are looking at the same indications and positioning themselves for the future halving with long exposure already now, planting some seeds in the slowly brewing crypto spring.

RANSOMWARE & AID - THE DARK & BRIGHT SIDE OF COLLECTING FUNDS

The world can be a scary place. If it isn’t manmade evil as targeted ransomware attacks against key national infrastructure it’s incredible suffering created by mother nature in the form of for example the devastating earthquake striking through Turkey and Syria.

So what has this to do with crypto? Well, in the latter example, the good part of humankind quickly came together to aid. And somewhat surprisingly, crypto has played a big part in the aid with a large number of large-scale fundraising activities initiated in just crypto. In just one week over $5 million was raised in mainly BTC, and that's just the type of public raising where the publicity matters too. Estimates range as high as 10x that amount when taking into consideration individual donors that have no interest in the publicity. Once again, a bright positive spotlight into the world of digital assets that also the general public gets told about.

On the other side, almost like the dark part of the Yin Yang symbol to the light, we have a troubling increase of cyberattacks raging across mainly western economies with ransomware being a big part of the operations. This is generally set in crypto, and the amounts are not small when for example Portugal's largest port gets shut down by ransomware or a German airport.

Although this can in any way be viewed as positive, the implications have to be mentioned as this in many cases generates quite a significant influx of new liquidity into the ecosystem.

And unfortunately, with the evidence pointing to the majority of these attacks coming from Russia or Russian allies in a way of conducting shadow warfare against the west, there is no reason to expect these types of situations to subside anytime soon. As a matter of fact, indications are rather that these attacks are trying to be ramped up, with US electricity- and gas plants experiencing a 200% surge in attempts of cyber attacks so far this year. And needless to say what the implications would be for any developed country having their electrical grid shut down for days.

STABLECOIN & REGULATORY FEAR

In about a week ago, the SEC has begun a wide-swept crackdown against both Kraken and Binance targeting Kraken staking service as well as Binance stablecoin.

This spurred some fear in the market initially but as the dust settled, it seems to be the case that the staking issue was actually Kraken-specific and not a generally targeted attempt to remove all staking. At least for now.

In the case of Binance, more specifically it was Paxos who was ordered to stop issuing the coins, and around $2.5 billion worth of BNB token shorts was quickly added to the market. This type of action is just primed for a massive short squeeze and large market participants weren’t late to the party for now, the issue lies with Binance and Paxos and not the whole stablecoin sector.

Worth mentioning is that only around 50% of the shorts have been covered, so there is still room for a further squeeze.

Around a similar amount, $2.5 billion, was however moved out of bUSD, and naturally, these weren’t converted into fiat, but rather the majority of flows went into Bitcoin, helping with the recent charge towards the 25k level.

These are some of the major developments. Now there are actually further factors such as the US inflation data for example that add further to the rally, but I can’t go into every single metric or this report would become pages on pages.

SO WILL THE CRYPTO SPRING TURN INTO FULL BLOOM

That is still a bit too early to say. An uptick in inflation for example would be very normal for the short to medium term, but could easily set us back for a period of time. But in either case, the market is forming a really well-anchored foundation to build on.

And just as Europe is starting to show signs of spring slowly approaching with warmer temperatures, more sunlight, and different fauna beginning to push up through the hard winter ground, so do we have signs of the crypto spring…

Momentum readings for the crypto market have subsided back into mid-ranges from overbought levels once again providing decent risk-to-reward setups while the two majors, BTC and ETH both are taking out significant levels to the upside.

The global crypto market increased +10.9% last week adding $1.17 trillion to the space which is very positive, especially considering statistics showed institutions taking some profits out of the market.

Global crypto trading volume increased by a whopping +17.8% to $84.7 billion with weekly revenues for specifically Ethereum followed suit increasing +13% week-on-week.

Total Value Locked (TVL), remains above its moving average and increased by +9% last week, showing that staking worries are not affecting the market, simply moving funds around.

Furthermore, Lido (LDO) dominates with 94.9% adding some very positive developments to the long LDO/BTC position Penning AIF is currently holding (+55% from entry).

Active BTC addresses increased by 10.2% week-on-week and the futures funding rate is also positive for both BTC and ETH showing the market is pricing in further gains.

So the signs sure are there with just a couple of clouds on the otherwise bright sky.

Therefore, I’m not cracking out the sunglasses and shorts just yet but I do think that even if we get another leg down for whatever reason, we have entered what I would call the accumulation period for the long-term investor, where I am happily starting to build long term holdings aligning with the strong base the market is currently building on.

Question is, what seeds am I going to focus on planting first?

- The Penalyst

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.