Digital asset markets suffer from some fatigue following the Ethereum Shanghai upgrade, as well as US regulatory chaos. The Penalyst would argue the market is in a little bit of a transition face right now, both from a value perspective and also from a fundamental and structural perspective. However we do have the BTC halving coming up, which in combination with US inflation readings are providing potential for one of the simplest, but potentially highly rewarding, investment strategies in a long time.

In the last update, I talked about how I expected 2023 to be a slow grind upwards, with classic technical pullbacks offering good opportunities for cost averaging into positions.

Looking at US inflation releases, BTC keeps following an easily predictive pattern of selling off into these releases, only to rally afterward. And I’m talking about long-term trends here between the monthly releases, not sudden rallies/drops.

With the “flight to quality” we are seeing, I would continue to argue BTC remains the main go-to for these types of strategies, and with the upcoming halving, timing-wise suggests now is the correct time to start implementing a strategy like this.

The US economy is coming down hard, and I expect US inflation to continue to fall, maybe even as far as sub 2% into the end of 2023. Add to that a growing performance of US tech stocks, and more and more metrics are lining up for a continued BTC, slow and steady, rally.

As such, someone looking to add BTC long exposure dips into each monthly US inflation report is providing great cost-averaging entries into next year.

Especially now with the dips being fueled by regulatory issues coming out of the US, causing short-term FUD. But long term, it’s my strong view that these will be heavily outperformed by positive regulatory news from both Hong Kong, the UAE, and to some extent the UK and Europe. All of these jurisdictions are working closely with large-scale market actors, and trying to win the race to become the optimal crypto area.

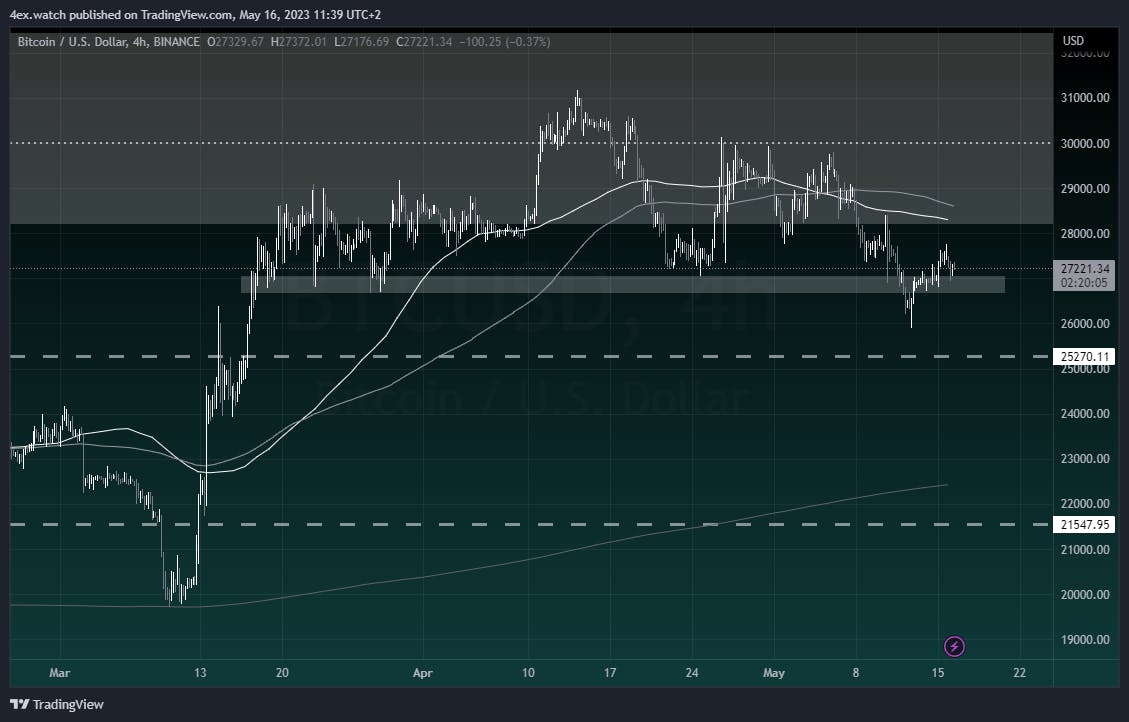

BITCOIN (BTCUSD)

On the technical side, BTC has taken a breather falling back out of the previously highlighted liquidity zone, making a classic liquidity sweep clearing out longs under the previously highlighted support zone, only to then squeeze freshly added shorts by regaining the zone in bullish territory again. Really classical price action that flushes out short-term positions and adds liquidity to long-term positioning.

In addition, we have the chance of some massive short squeezing in the NASDAQ, which could add fuel to the rally, but more on that in the below section for the NASDAQ.

On the upside, we need to see BTC overtake the short- and long-term Moving Averages before any real test of the large liquidity zone can take place, and a new push towards 31 000.

I am expecting this rally to resume sooner rather than later.

US DOLLAR INDEX

Just as we’ve seen BTC taking a breather, so has the US dollar been allowed to get back off the ropes and for a period, saved from the vicious bearish pounding it has been suffering.

However, it seems the prime Mike Tyson bears are gearing up again, and the US dollar has begun taking a rather heavy beating over the last 24 hours.

I’m expecting a test of the moving averages in the near future, and then a test of the lower bands of the recent consolidation pattern.

Maybe, as the USDX test of 100 is on the horizon in the very near future.

NASDAQ100

US tech stocks continue to show resilience, and as mentioned in the BTC section above, there are high odds of this continuing.

Hedge funds remain massively hedged on their equity holdings. Looking at SP500 CFTC data, positions are equivalent to 2008 financial crisis levels and 2011 EU debt crisis levels.

Although this doesn’t necessarily mean Hedge funds are short, it’s more likely to be hedging positions, they will need to exit these contracts at some point, and when doing so a rather massive short squeeze might be on the books as everyone scrambles for the exit.

So, when will that happen might be your question? Well, one can only speculate. But I wouldn’t be surprised if the FED Jackson Hole meeting at the end of August will be a massive turning point with the FED signaling future rate cuts, and such triggering a change in long-term positioning from hedge funds.

CLOSING COMMENTS

The year is progressing as expected, and it’s making markets rather easy to navigate. Penning AIF is up 61% YTD as a result of this, and hopefully, any readers of these reports are finding similar value to their portfolios from the information in the updates.

- The Penalyst

*Disclaimer: This article is not financial or investment advice, nor should it be perceived as such. Penning Group and the author (Timothy Hellberg) shall not be held accountable for any misinterpreted information by the reader. If you are interested in learning more about investing in the DeFi space, please get in touch with us.